-

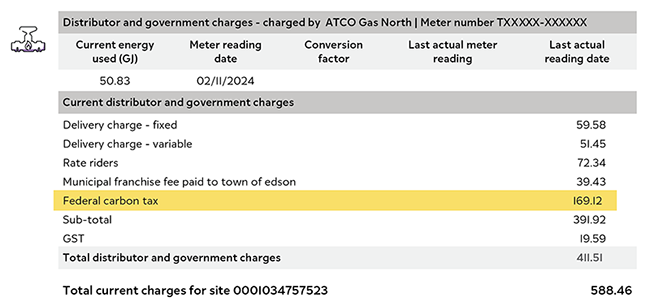

Starting April 1, 2025, you will no longer be charged a Federal Carbon Tax on your natural gas usage. Learn more about changes to the consumer carbon price and federal fuel charge.

-

Pay your bill

Please verify your service location to access this:

-

Sign up for fixed rates: 1-855-452-8869Direct Energy customer support: 1-866-374-6299Direct Energy Regulated Services sales & support: 1-866-420-3174

Please verify your service location to access this:

-

Plans for home

2 FREE months of electricity* is back

Feel the free when you choose a 2-year bundled plan.*

-

Plans for business

Our energy plans for your business are not one-size-fits-all.

Check out our energy plans for restaurants and learn how to make your business more energy efficient.

-

Learning centre

Your go-to resource for all things energy related in Alberta.

Want to know more about your energy options? Looking for ways to save on energy usage? We're here to help you make an educated decision.

-

Our new app

Meet our new app

The only energy account app in Alberta‡—built to give you fast, easy access to bills, insights, rewards and more.

New to Direct Energy? Get an exclusive offer when you download the app.§

-

Support

Sign up for fixed rates:

Direct Energy customer support:

Direct Energy Regulated Services sales & support:

2 FREE months of electricity* is back

Feel the free when you choose a 2-year bundled plan.*

Our energy plans for your business are not one-size-fits-all.

Check out our energy plans for restaurants and learn how to make your business more energy efficient.

Your go-to resource for all things energy related in Alberta.

Want to know more about your energy options? Looking for ways to save on energy usage? We're here to help you make an educated decision.

Please verify your service location to access this: